The easy way to compare and research annuities.

See which annuities can provide you the most benefits throughout your retirement without having to meet with a financial advisor in-person.

The easy way to compare and research annuities.

See which annuities can provide you the most benefits throughout your retirement without having to meet with a financial advisor in-person.

Skip the smoke and mirrors. Research with confidence at Annuity Gator — the original annuity ‘investigator’.

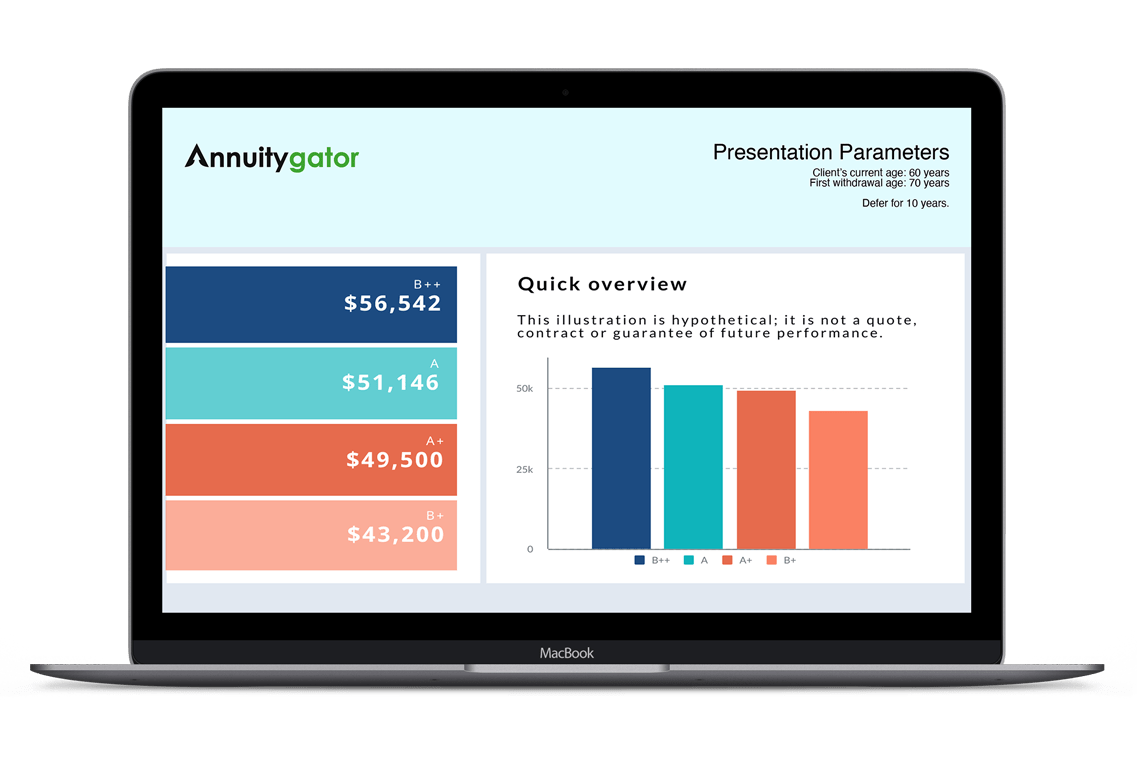

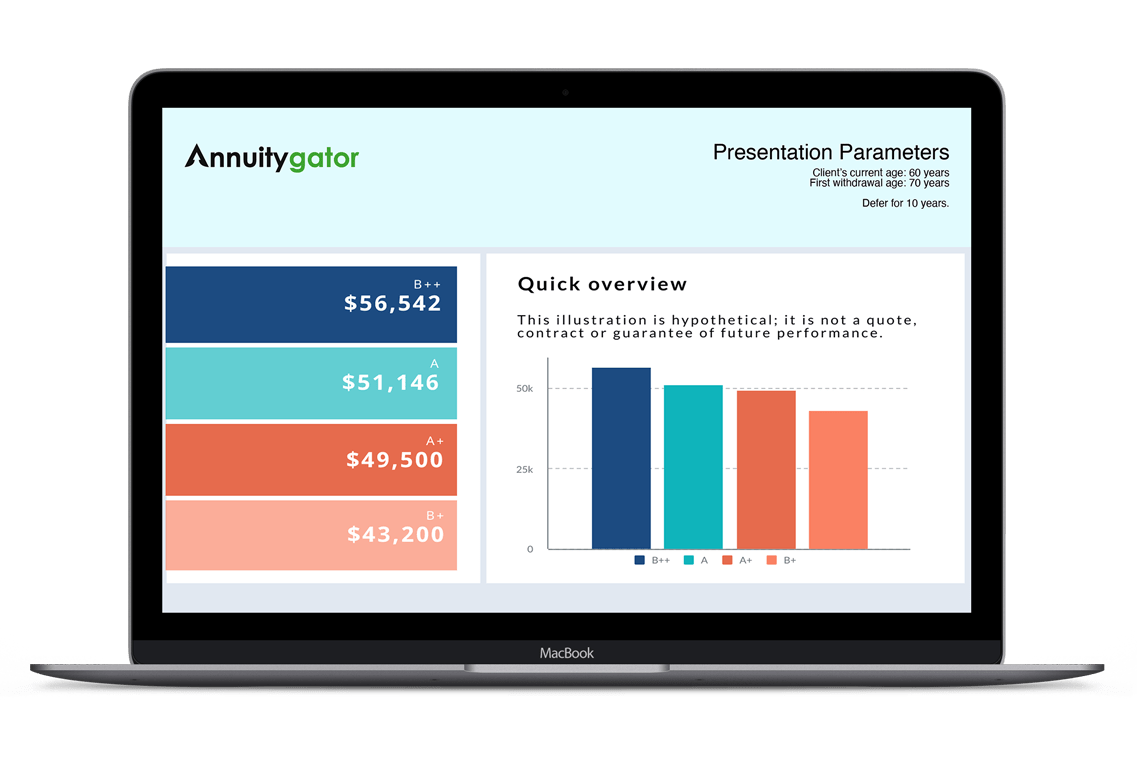

Answer a few simple questions and we’ll instantly show you which annuities you may want to consider.

Get free annuity feedback and guidance instantly without having to talk to a high-pressure sales agent.

Our annuity ranking software will help you compare the best annuities and recommend customized strategies, so you can get the most bang for your buck.

Skip the smoke and mirrors. Research with confidence at Annuity Gator — the original annuity ‘investigator’.

Answer a few simple questions and we’ll instantly show you which annuities you may want to consider.

Get free annuity feedback and guidance instantly without having to talk to a high-pressure sales agent.

Our annuity ranking software will help you compare the best annuities and recommend customized strategies, so you can get the most bang for your buck.

No overwhelming annuity whitepapers or slick company brochures. No high-pressure sales tactics. We’ll provide you with honest annuity guidance and personalized annuity recommendations. We focus relentlessly on three things:

Honest guidance. Best annuities. Personalized for you.

No overwhelming annuity whitepapers or slick company brochures. No high-pressure sales tactics. We’ll provide you with honest annuity guidance and personalized annuity recommendations. We focus relentlessly on three things:

Honest guidance. Best annuities. Personalized for you.

We promise to be honest with you. That means full transparency for our recommendations on annuities for retirement, which includes fees, best and worst case scenarios — and yes, even our annuity commissions.

We promise to be honest with you. That means full transparency for our recommendations on annuities for retirement, which includes fees, best and worst case scenarios — and yes, even our annuity commissions.

Our annuity research and retirement income planning experts have over 25 years of experience helping clients financially prepare for retirement. Our in-depth annuity reviews and research have identified annuities with the lowest fees that deliver the highest guaranteed income and benefits. All annuities that we recommend are backed by the top rated insurance carriers.

Our annuity research and retirement income planning experts have over 25 years of experience helping clients financially prepare for retirement. Our in-depth annuity reviews and research have identified annuities with the lowest fees that deliver the highest guaranteed income and benefits. All annuities that we recommend are backed by the top rated insurance carriers.

Everyone we help is unique. But with the differences in our financial goals and retirement lifestyles, the idea of a one-size-fits-all annuity is outdated. Annuity benefits regularly change and annuity recommendations will vary based on your age, state and your retirement goals. We’ll help find what’s right for you, with minimal effort on your part.

Everyone we help is unique. But with the differences in our financial goals and retirement lifestyles, the idea of a one-size-fits-all annuity is outdated. Annuity benefits regularly change and annuity recommendations will vary based on your age, state and your retirement goals. We’ll help find what’s right for you, with minimal effort on your part.

More transparency, no hype.

We take your retirement happiness and security very seriously and we will provide you with independent annuity guidance and recommendations so you can retire with confidence.

More transparency, no hype.

We take your retirement happiness and security very seriously and we will provide you with independent annuity guidance and recommendations so you can retire with confidence.

We have over 100 retirement annuities in our review database.

We have over 100 retirement annuities in our review database.

AnnuityGator.com offers independent annuity product reviews. Nothing on this website is a recommendation to buy or sell an annuity. All content is for educational purposes only. No product companies have endorsed the reviews on this site, nor is AnnuityGator.com compensated for reviews. Reviews are posted at the request of readers so they could see an independent perspective when breaking down the positives and negatives of specific annuity contracts. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional should you have specific questions as they relate to your individual circumstances. All names, marks, and materials used for the reviews on this site are property of their respective owners, and not those of AnnuityGator.com. Annuity product guarantees rely on the financial strength and claims-paying ability of the issuing insurer. Annuity riders may be available for an additional annual premium that can provide additional benefits and income guarantees. By contacting us you may speak with an insurance licensed agent in your state, and you may be offered insurance products for sale.

©AnnuityGator. All Rights Reserved | Privacy Policy